Chancellor George Osborne has fought moves to introduce such a tax, warning it would harm the financial sector.

But Mr McDonnell believes it could rein in the excesses of the City and help pay for improvements to the NHS and other public services reports the BBC.

He will also set out arguments for “new economics” in his address on Monday.

The shadow chancellor will say a future Labour government will live within its means, investing to grow the economy and sharing proceeds “more equally”.

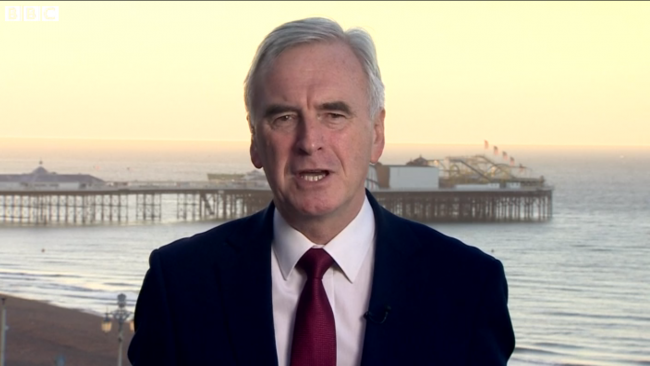

He told BBC Breakfast he would launch “a national debate”, but warned that some people might be disappointed by his speech, as it would not contain “all the exciting things” written about by the national media.

He denied reports he was planning big tax increases, saying his speech could be “pretty boring”.

Taxation review

On Sunday, Mr McDonnell told a fringe meeting at the Labour conference in Brighton that he had reached an agreement with shadow business secretary Angela Eagle over the Financial Transaction Tax – the so-called Robin Hood tax.

He will launch an “open” debate within Labour with a view to making the introduction of such a measure party policy, he said.

Mr McDonnell has long campaigned for such a tax and revealed that he had a furious row with his predecessor as shadow chancellor, Ed Balls, when he tried to secure a Commons debate on the issue.

Asked about the issue, he said: “Robin Hood tax at the moment is Labour Party policy on the basis of if we can introduce it globally, and that’s been Labour Party policy for some time now.

“However, what we are saying is today we are going to launch a review of our taxation system, we are going to bring the greatest economic minds in the world to bear on that issue, we are going to consult with the British people and then we will arrive at a decision on the way forward.”

David Hillman, of the Robin Hood Tax campaign, which has gathered more than a million signatures on its petition, told the conference meeting there was nothing “dangerous or radical” about the idea, which he said had support from across the political spectrum in Europe.

The point of the tax, which would be levied on stock and foreign exchange trades, would be “to have the banks and hedge funds pay for, or at least contribute to paying for, the immense economic damage their gambling, essentially it was gambling, had caused,” he said.

Mr McDonnell said he would also use his speech to “demand” access to the financial models used by the Office for Budget Responsibility and the Bank of England to help Labour formulate an alternative economic policy and calculate the rate at which a Robin Hood tax could be set.

“I think that should be open to all parties in Parliament” to test their own ideas “in advance of getting into government,” he added.

Tax review

He will also announce a review of Her Majesty’s Revenue and Customs to find out how it could beef up its efforts to collect the billions of pounds avoided by UK companies and individuals every year.

Mr McDonnell said he wanted to examine every aspect of HMRC, “its operations, effectiveness and also look at its range of policies and the instruments that it has available to it to ensure that we maximise our tax take and at the same time it’s done on a fair and just basis”.

During his Labour leadership campaign, Jeremy Corbyn claimed £120bn could be recovered from tax avoidance and evasion – enough to eliminate the UK’s budget deficit without cutting welfare or public spending.

But critics, including the then shadow chancellor Chris Leslie, said it was not a plausible policy and would not work.