It has been studied that the bureau has brought forward some new rules which would make it mandatory for the payday loan lenders to verify and check the repayment ability of the borrower before lending him a loan and restrict some fee and lending practices.

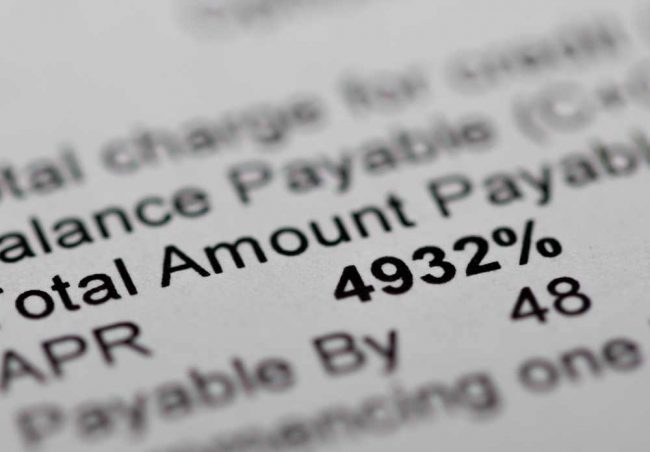

Payday loans are usually tied to the next payday of the consumer and such loans have a typical APR or Annual Percentage Rate of 390%, as per expert lenders. There are numerous borrowers who live from one paycheck to the next with pretty unstable income and they are the ones who need such loans to cover their basic necessities and their mid-month financial contingencies.

Payday loan lending changes that are being proposed in the industry

Now that you know there are some changes coming in, here’s what you need to know about them.

Lenders need to ensure borrowers can repay the loan

The lenders have to perform the ‘full-payment test’ which require lenders to verify that a borrower has the ability to make repayments in full on time and still be able to meet his basic living expenses and all other financial liabilities that he has. There are too many borrowers who seek help of payday loans and are later on saddled with long term debt which they find it impossible to repay. This should be stopped immediately.

Lenders need to put an end of the cycle of ‘debt trap’

The new proposals are also meant to end the so-called debt traps which exist within the industry. Now on it would become tougher for the lenders to refinance or re-issue the loans of the borrowers. It has been seen that more than 80% of the payday loans are re-borrowed in the following month of taking out the loan. The new rules would henceforth prevent the lenders from issuing a same loan to a borrower who is looking forward to roll over his previous loan.

Lenders need to put a regulation on penalty fees

Majority of the payday loan lenders receive access to the checking accounts of the borrowers due to which they can themselves collect payment on the pre-fixed date. However, it is to note that unsuccessful withdrawals on a particular account can give rise to hefty fees both from the bank of the debtor and from the lender. As per the new rules, a lender should provide a written notice to the borrower where he would mention the amount of money he is about to debit from his account and the date on which he will do the same, at least 3 days before his attempt.

Is there a sharp fall in the number of people taking out payday loans?

As per the survey from UK’s insolvency trade body R3, the total number of people who take resort to payday loans has plummeted significantly in 2016. Researchers conducted an interview among more than 2000 adults and it was surprisingly found that 0% of the people surveyed in the North West took out payday loans in the last 6 months. As compared to the previous survey in early January, 2015, it was seen that 3% in that specific region admitted that they took out payday loans and in September 2014, it was 8%.

The research also found that in the North West, people are more likely to dig into their personal savings account or reduce their expenses in order to bridge the gap in their finances instead of using credit cards and payday loans. Richard Wolff, North West chair of R3 said that this decline in the use of payday loans is definitely good news.

Payday loans are undoubtedly good ways of managing your mid-month financial issues but if you are not able to pay back on time, this may lead to high interest debt. Hence, if you don’t think you can manage timely repayments, it is better to go back to the old-school methods of balancing your budget and reducing your expenses.