While the self-assessment tax deadline isn’t until January 31st, there have been increases of self-employed workers in the UK choosing tax returns over turkey by finding 25th December the ideal time to submit tax forms online with HM Revenue & Customs (HMRC).

While people may be missing out on festive fun during the Christmas period, filing early is encouraged by HMRC.

If the deadline of 31st January is missed, HMRC will automatically issue you a £100 penalty, and will charge interest on any unpaid tax. Business owners may be able to ask HMRC to waive your penalty, but only if they have what HMRC consider a “reasonable excuse” for not filing your return. If you meet the criteria, you can file a claim form.

Ed Molyneux, CEO and co-founder of FreeAgent, who provide award-winning online accounting software to freelancers, small businesses and their accountants, said: “The festive season is a time for family, friends and celebrations. It is a chance to destress and ideally put your feet up. Despite the paramount importance of filing taxes, the task is becoming a time-thief on one of the most joyous days of the year, Christmas. There is no good reason for this, it just takes a bit of preparation and knowing what rules to follow to skip the Christmas tax panic.

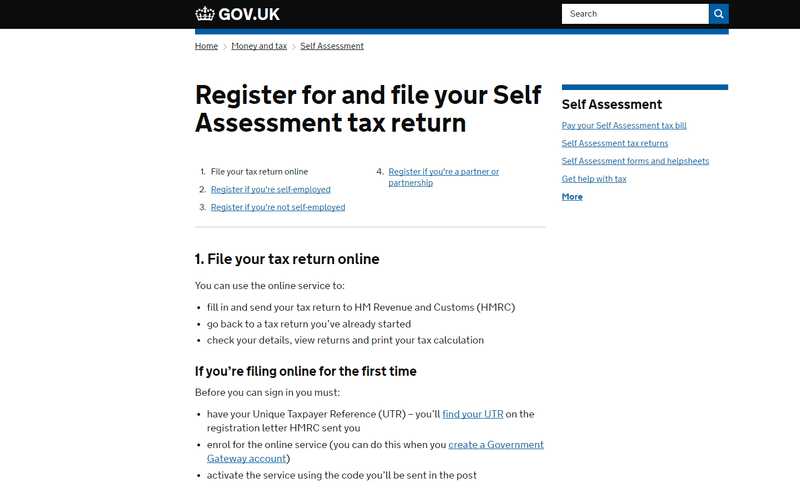

My advice to business owners is threefold: firstly, register with HMRC and give yourself a few weeks to complete the process, you aren’t able to submit your tax returns without it. Secondly, you’ll need to gather all your information before you can file your tax return.

As a basic rule, this will be any money you’ve received or earned from pretty much anywhere – including wages from a job, income from a trust, interest from your bank account (except an ISA) and profits from operating a sole trader, limited company or a partnership. Finally, consult HMRC’s website or a professional accountant or tax advisor to make sure you have complete clarity about all the regulations in place specific to your business – follow these religiously so as to avoid any back and forth.

In a world where people work hard all year round, making time for yourself and the people you value is of increasing importance. The festive season is the perfect time for this, so get organised and thank yourself on Christmas day when you will be able to sit back and soak up the joy of a stress-free celebrations with those who matter most to you.”