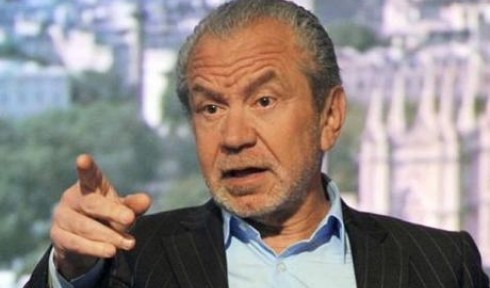

This follows recent criticism by Lord Sugar, the government’s

enterprise champion, who described struggling small companies as

“moaners”.

Most small businesses have used their own cash to

get through the recession rather than rely on banks, the study by

Kingston University shows.

Only a quarter of the 343 firms surveyed saw significant profit falls.

“More than half of small business owners survived the recession and the

squeeze on credit by using their own savings and personal credit

cards,” the study said.

“This finding is a clear contradiction that all small and medium-sized businesses would suffer heavily in the downturn.”

It cited small businesses’ ability to “adapt, survive and thrive” in the downturn.

About 48% maintained or increased their profitability in the past year, it said.

‘They are bust’

Lord Sugar made his comments at a business event run by the Federation of Small Business in Manchester last week.

“I can honestly say a lot of problems you hear from people who are

moaning are from companies I wouldn’t lend a penny to,” he said.

“They are bust and they don’t need the bank – they need an insolvency practitioner.”

Formerly Sir Alan Sugar, he was made a Lord earlier this year so that he could join the government.

The Federation of Small Businesses also defended small firms, saying

they “lie at the heart of our economy”, adding they were “working hard

in difficult times”.

The Kingston University study surveyed

343 companies occupying commercial and industrial premises owned by

Workspace Group, who lease business space and commissioned the survey.