SimpleTax is the first of its kind in the UK and similar to the de-facto US tax filing solution TurboTax. The service is completely automated and as the only online service recognized by the HMRC, customers can be sure their information is secure. SimpleTax is the evolution of a similar service the team developed in Portugal which experienced notable success, with one-in-five self-employed taxpayers becoming a customer and resulting in average savings of £250 per tax return.

“Every year, many UK tax returns are filed incorrectly or after the January 31 deadline which is likely, in part, due to the complicated processes in place for those who don’t have an accountant,” said Mark Hodges of Horizon Accounts, tax advisers to SimpleTax. “The introduction of a taxpayer friendly service is a significant step in simplifying the process for everyone who has to file their own self-assessment return.”

How it Works

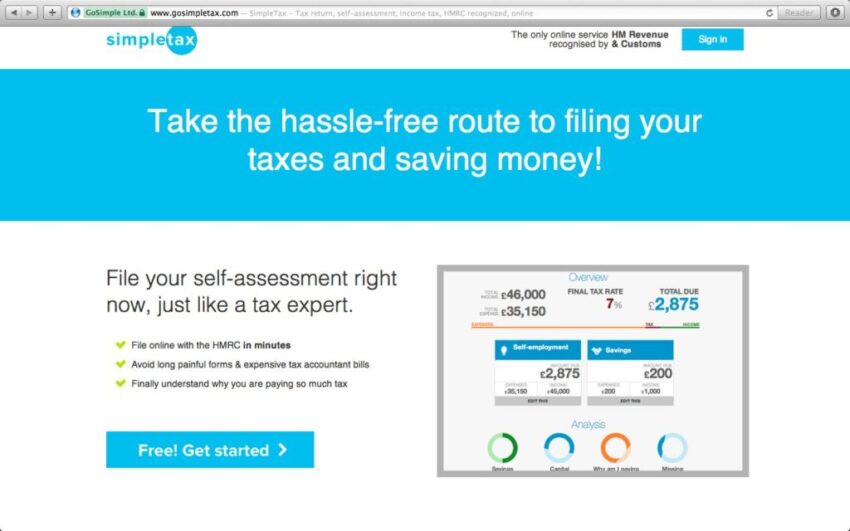

SimpleTax allows you to quickly and easily file your taxes online in a way that is easy to understand, streamlining the complicated and lengthy processes currently in place. UK taxpayers create an account and can immediately begin entering their income and expenses, with SimpleTax doing all the work in background making sure individuals are saving time and money.

Once tax returns have been completed online using SimpleTax, the information can be transferred and stored for future filings.

SimpleTax was created with self-employed taxpayers needs in mind and helps them:

- Submit their tax returns ahead of the deadline of 31st January and at their own pace throughout the year so as to avoid paying late filing penalties.

- Understand why they’re paying this tax amount in a clear, logical way.

- Figure out ways of saving money on taxes, understanding that it’s often small things which unnoticed and tend to add up.